Compliance

AML Suite

System made up of four applications that cover the processes of: customer evaluation and registration, KYC, regulatory due diligence, laundering risk calculation and transaction monitoring, in accordance with current laws and regulations.

Discover the advantages of our AML Platform

Clients Inspector provides your organization with an all-in-one solution capable to integrate to your current compliance workflow and due diligence, screening against the major global watchlists of wanted or sanctioned people.

Continuous system of depuration of your customers against major global watchlists and your private watchlists.

Real-time monitoring of your customers activity including alert generations in case of changes in their behaviours.

KYC and due diligence process automated and integrated to the incorporation of new customers.

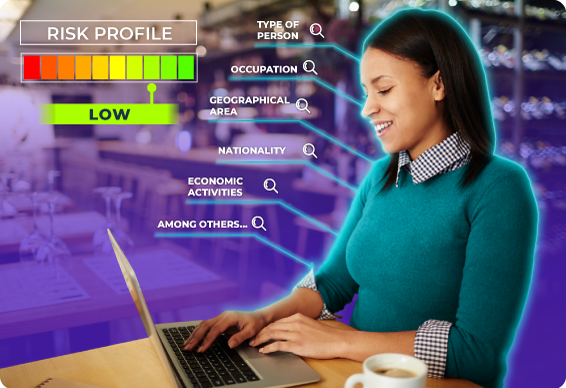

Application that allows your organization to determine and assig the risk profile of money laundering of your customers through rules and configurable matrices that incorporate the variables required by local regulations.

Permanent processes for calculating the risk of money laundering of all your customers.

Risk matrices fully configurable.

Easy integration with external services that require risk level calculation.

Alert notifications when changes the money laundering risk level of your customers.

Allows your organization to monitor in real time the transactions made by your clients.

Real time dashboard of the transactions that occur in the core-system of the entity.

Allows the configuration of rules to detect, block and report unusual or suspicious transactions.

Allows customer segmentation by groups to assign special monitoring rules.